Almost half of students in the UK find day-to-day finances a source of stress, according to a student lifestyle survey published today by Times Higher Education.

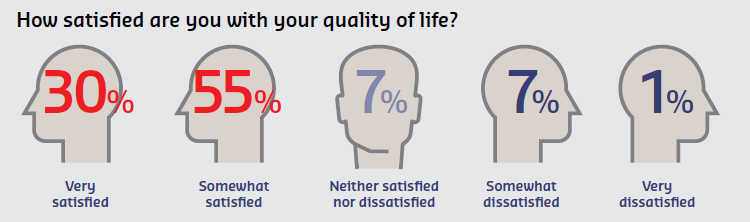

Even though 85 per cent of students were broadly satisfied with their quality of life at university, the proportion of students worrying about daily money troubles has increased by 6 per cent since last year, now up to 48 per cent.

One reason for this is the rise in rental costs. Ten years ago, only 10 per cent of students paid more than £400 per month for accommodation, compared with 30 per cent today.

Perhaps unsurprisingly, 28 per cent of students report spending no money at all on their social life – double the 14 per cent who said so just three years ago.

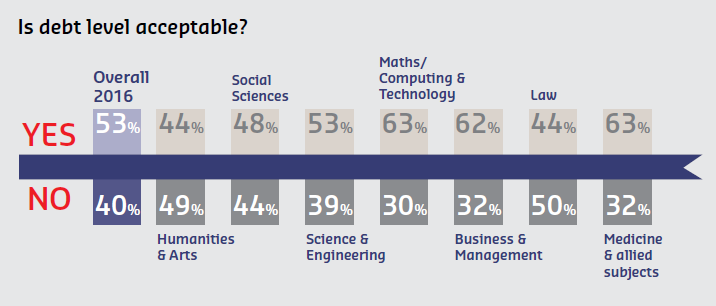

Despite this frugality, there has been a significant increase in how much debt students expect to graduate with, and also in the number of students saying that their expected level of debt is unacceptable given their future career prospects.

Twenty-nine per cent estimate that they will carry more than £40,000 of debt with them upon graduation, but the most dramatic change sees 66 per cent of students anticipate more than £20,000 of debt – double the proportion in 2012, before £9,000 tuition fees were introduced.

The mounting debt also seems to be affecting student priorities and motivations. Only 21 per cent of students named “a good social life” as an important factor in their decision to go to university – the lowest number ever since the survey launched in 2004.

Considering the abolition of student maintenance grants from September 2016, 21 per cent of current students said that they would have delayed going to university in order to work and save money, and, even more worryingly, 18 per cent said that they would have decided not to go to university at all.

However, students also rely on other main sources of financial support: maintenance loans (75 per cent of students), tuition fee loans (62 per cent) and “the Bank of Mum and Dad” (49 per cent).

Zain Rizvi, a third-year student at Cass Business School, City University London, said: “The high cost of university definitely didn’t deter me, but I’m conscious that my loans will have to be paid back eventually.”

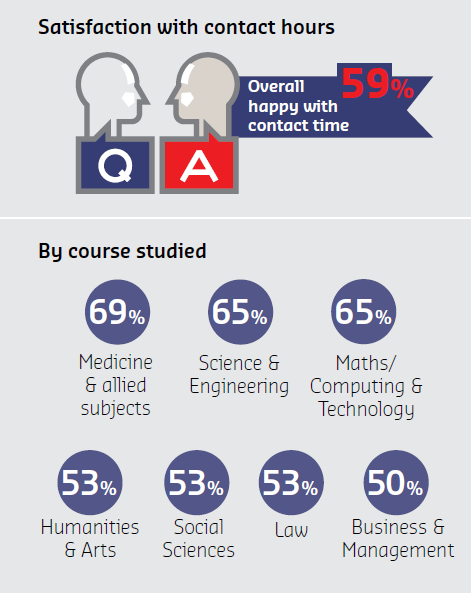

In one key respect, students are surprisingly satisfied; just under 60 per cent of students across all subjects said that they were happy with the number of contact hours they have with their teachers, and only 34 per cent said that they did not have enough lessons.

But the question is still open as to whether university in the UK is worth the money. The same proportion (53 per cent) felt that their university did not offer value for money as felt that it was worth the cost when considering long-term career benefits.

Comments